Contents

- 1 Marketing Service Categories & Keyword Selection

- 2 Data collection & analysis

- 3 Marketing Data Results

- 3.1 Overall Market Recovery

- 3.2 Market Recovery by State or Territory

- 3.3 Market Recovery by Service Category

- 3.4 Market Recovery by Services for ACT

- 3.5 Market Recovery by Services for NSW

- 3.6 Market Recovery by Services for NT

- 3.7 Market Recovery by Services for QLD

- 3.8 Market Recovery by Services for SA

- 3.9 Market Recovery by Services for TAS

- 3.10 Market Recovery by Services for VIC

- 3.11 Market Recovery by Services for WA

- 4 Insights

The year 2020 was a roller-coaster for the Australian economy. Business restrictions imposed by the Government on the 18th of March started a slide in economic activity only partly recovered by year-end.

The marketing industry feeds off the general state of the economy. The pandemic forced businesses to scale down operations, with many reviewing their marketing budgets.

We decided to look at the numbers to see how well search demand for the most common marketing services has held up over the last 19 months.

Marketing Service Categories & Keyword Selection

The service categories selected are the most commonly searched for digital marketing services, in our opinion. These are namely:

- Marketing

- SEO

- Social Media Marketing

- PPC

- Web Design

- Branding

The top search terms were selected for each of the service categories. These are namely:

Marketing: digital marketing agencies, marketing agency, digital marketing, marketing company, content marketing agency, marketing consultant, digital marketing company, digital marketing services, content marketing companies, marketing services

SEO: SEO, SEO agencies, SEO company, SEO services, SEO specialists, SEO consultant, SEO expert, SEO firm, SEO marketing company, SEO marketing

Social Media Marketing: social media marketing agency, social media agency, social media management, social media, social media marketing company, social media consultant, social media services, social media agencies, Instagram marketing, Facebook marketing

PPC: PPC, PPC company, PPC management, PPC agency, AdWords management, AdWords agency, google AdWords, Facebook advertising, Facebook ads agency, social media advertising

Web Design: web design, web design company, web design agency, WordPress web design, eCommerce web design, web design services, web design companies, custom web design, cheap web design, small business web design

Branding: branding agency, branding, branding company, branding companies, branding agencies

The keyword terms were further modified to include the capital for each of the eight states and territories in Australia: Example: web design + Melbourne

The state and territory capitals are:

- Victoria: Melbourne

- South Australia: Adelaide

- Western Australia: Perth

- Tasmania: Hobart

- Queensland: Brisbane

- New South Wales: Sydney

- Northern Territory: Darwin

- Australian Capital Territory: Canberra

Doing this, a total of 440 keyword terms were generated, 55 keywords for each state or territory.

Data collection & analysis

Each keyword was run in the Google AdWords Keyword Planner for these date periods:

- 1st Pre-COVID-19: 01 January 2018 to 31 December 2018

- 2nd Pre-COVID-19: 01 January 2019 to 31 December 2019

- COVID-19: 01 January 2020 to 31 December 2020

- Post-COVID-19: 01 January 2021 to 30 September 2021

Average monthly search data utilized in our report. Definition as per Google AdWords:

Average monthly searches (“Avg. monthly searches”) shows the average number of searches for this keyword and its close variants based on the month range as well as the location and Search Network settings you selected.

The 1st and 2nd Pre-COVID-19 periods are there to give us a benchmark, with the 2nd used as an anchor point to measure recovery. A big assumption is that Post-COVID-19 would start at the beginning of 2021 but due to the fact that we’ve only had nine months for the year, it made sense to use that.

The shorter data set for 2021 also meant that we had to use averages to compare the years. Hence we admit that the information available is not ideal but as a rough guide, would still provide key insights into how the industry has done.

Marketing Data Results

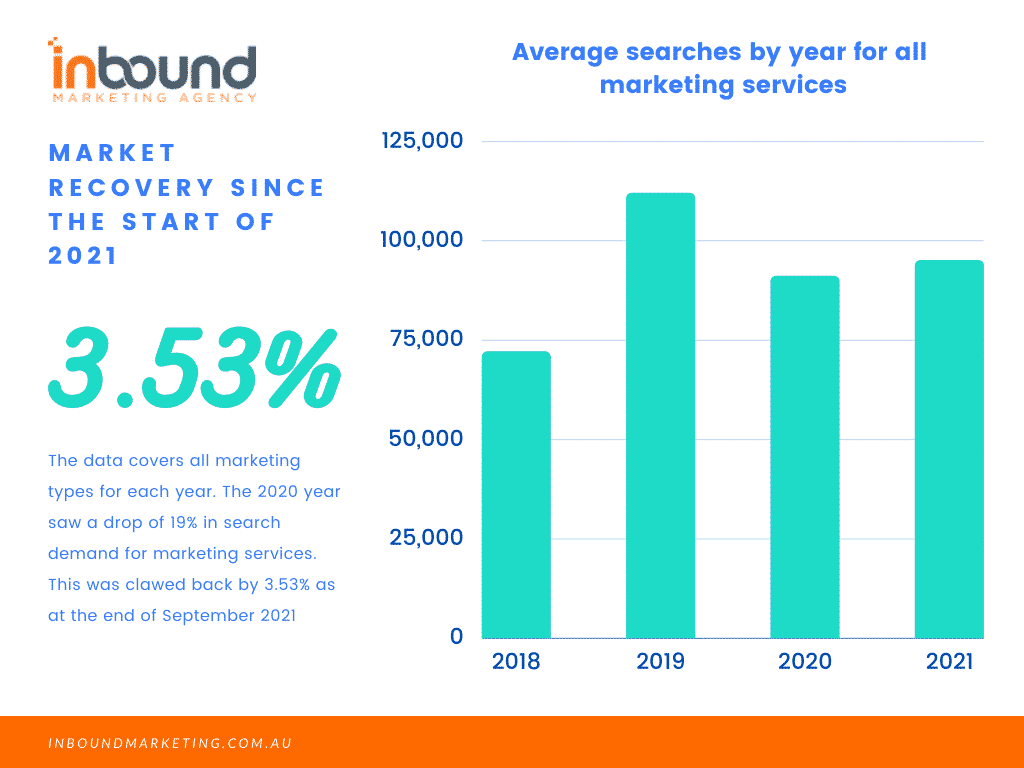

Overall Market Recovery

Data used: Average monthly searches by year

Marketing services: All

Region: All

By looking at the average total searches in 2019 compared to 2020, there was a 18.65% drop in searches. Comparing the 2019 figure to the 2021 numbers, we get a 15.12% drop.

This shows a recovery of approximately 3.53% for the sector as a whole.

Note: All recovery figures mentioned look at the percentage change between 2019 and 2021.

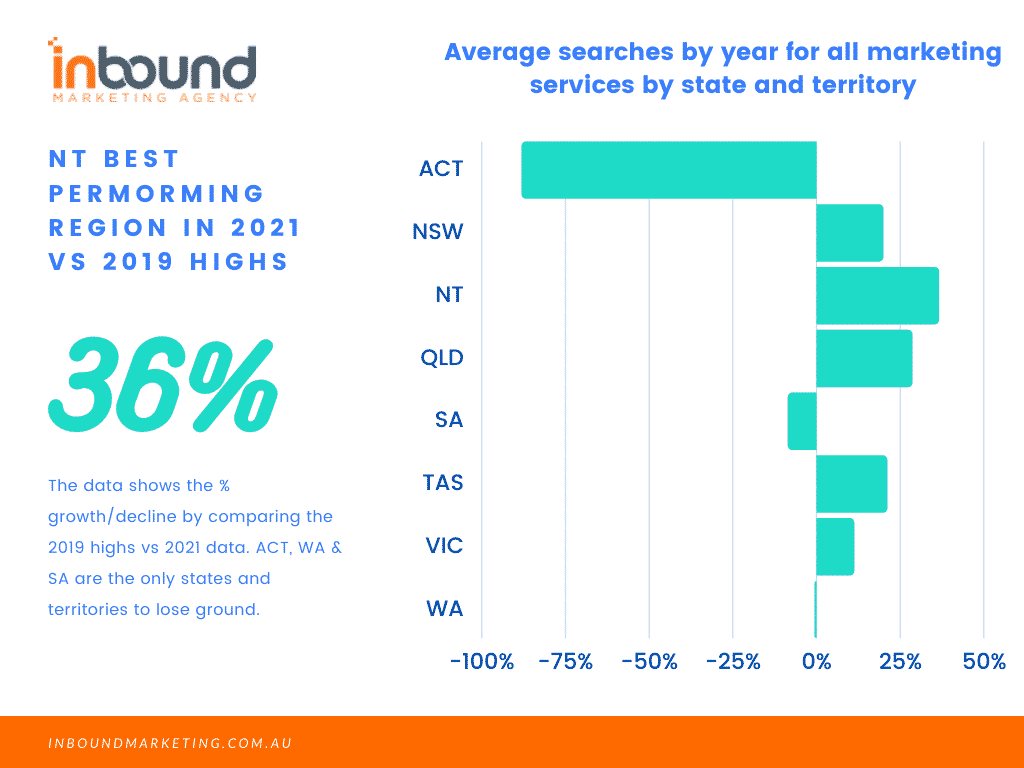

Market Recovery by State or Territory

Data used: Average monthly searches by year

Marketing services: All

Region: By state or territory

Breaking the figures down by location, we can get a sense of how regions have performed.

Five states and territories have exceeded their 2019 figures, namely, NT (36.48%), QLD (28.51%), TAS (21.03%), NSW (19.84%) & VIC (11.15%)

Three states and territories that still fall under their 2019 figures: ACT (-87.97%), SA (-8.46%) & WA (-0.44%)

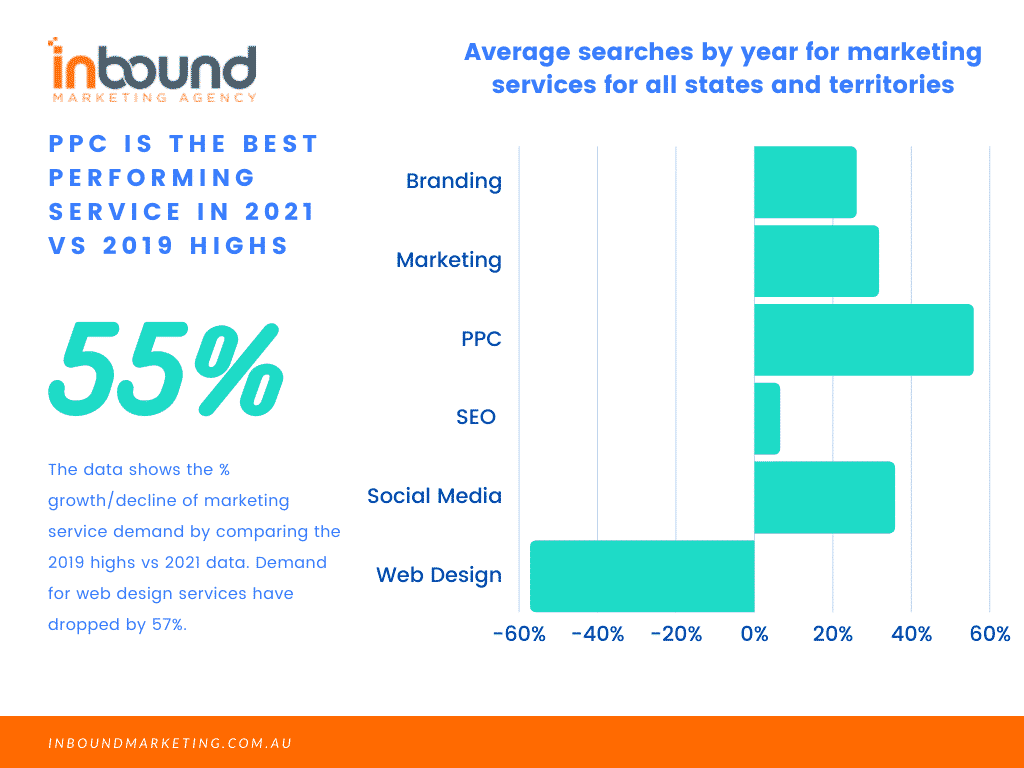

Market Recovery by Service Category

Data used: Average monthly searches by year

Marketing services: By service category

Region: All

This gives us an idea of the demand for certain marketing service categories since 2019.

Only one service category saw a decline: Web Design (-57.07%)

The remaining service categories all exceed their 2019 figures: PPC (55.78%), Social Media Marketing (35.73%), Marketing (31.65%), Branding (25.95%) & SEO (6.44%)

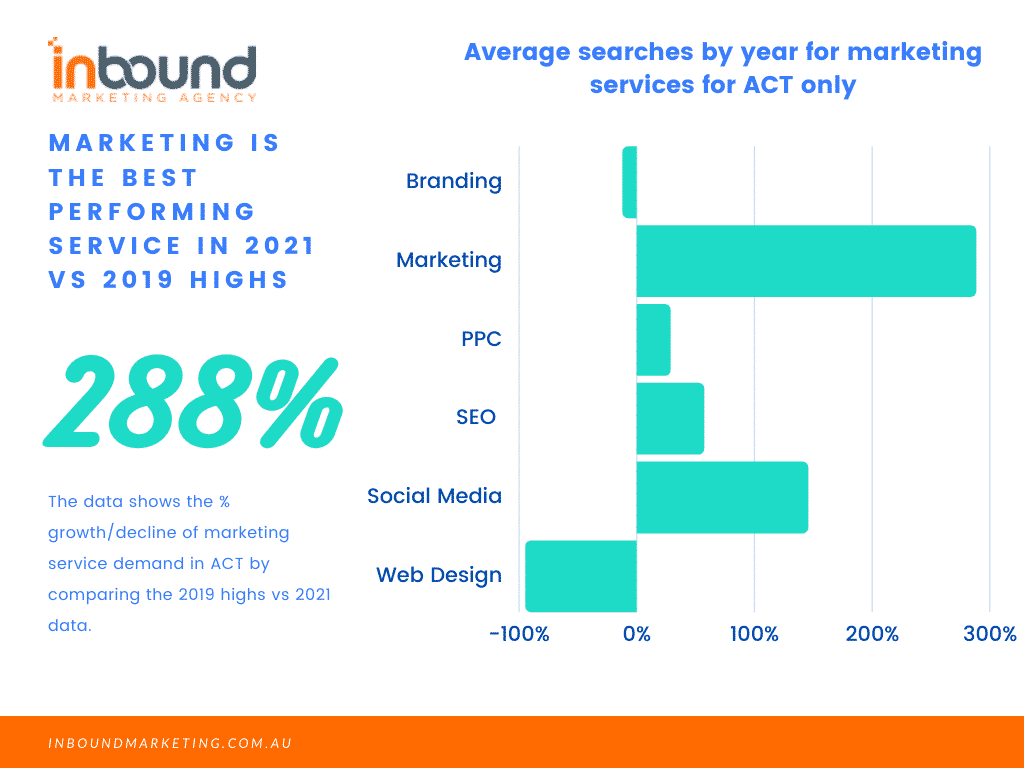

Market Recovery by Services for ACT

Data used: Average monthly searches by year

Marketing services: All

Region: ACT only

ACT overall has had a poor recovery (-87.97%) but this is largely due to abnormally high demand for web design services in 2019. This effect should be noted, as it is significant.

ACT has seen increased search demand for four service areas: Marketing (288.12%), Social Media Marketing (145.37%), SEO (56.96%) & PPC (28.40%)

ACT has seen a decrease in search demand for two service areas: Web Design (-94.27%) & Branding (-11.80%)

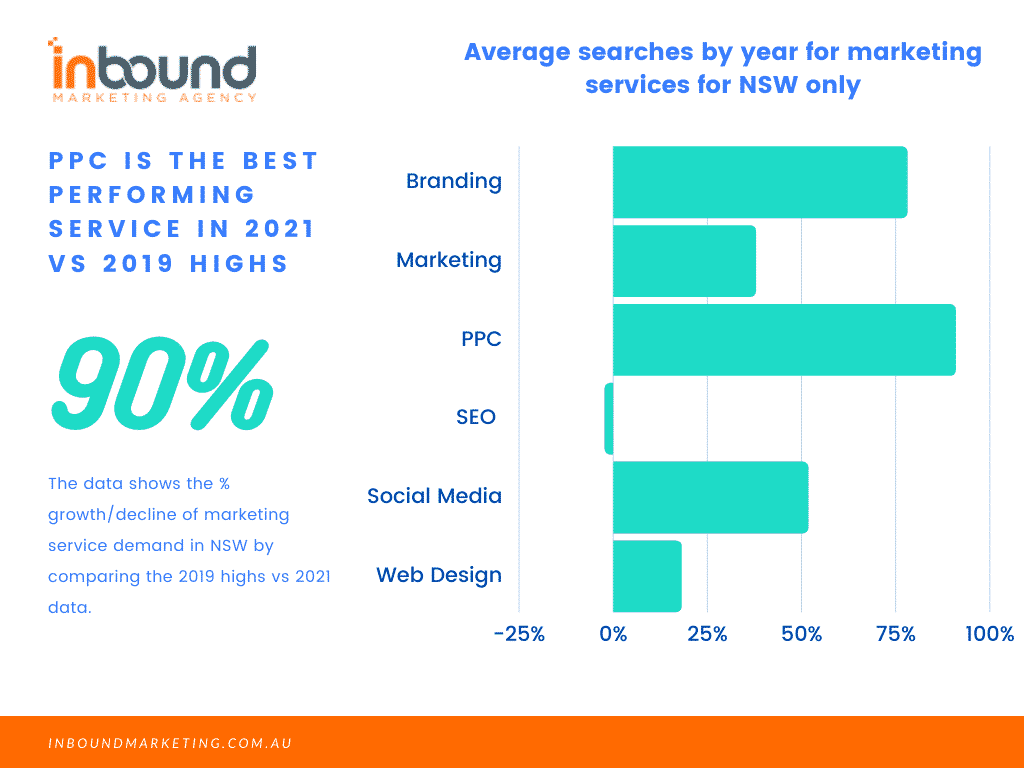

Market Recovery by Services for NSW

Data used: Average monthly searches by year

Marketing services: All

Region: NSW only

NSW overall has had a good recovery (19.84%) in search demand.

NSW has seen increased search demand in five service areas: PPC (90.88%), Branding (78.03%), Social Media Marketing (51.72%), Marketing (37.81%) & Web Design (18.07%)

NSW has seen a decrease in search demand for one service area: SEO (-2.18%)

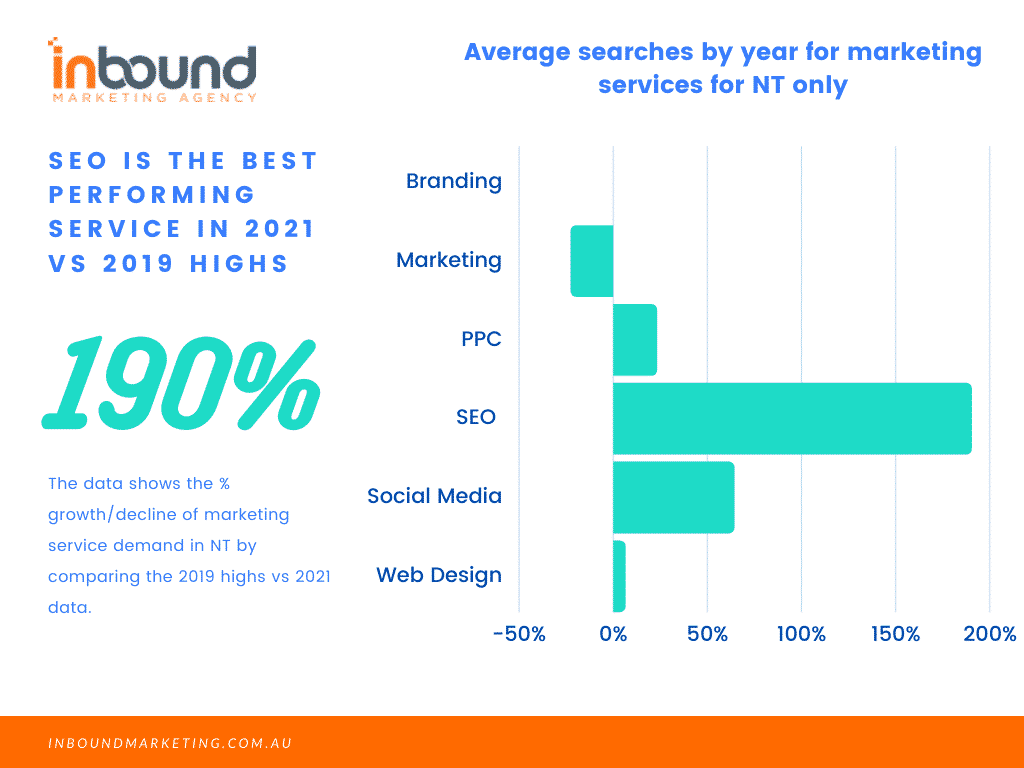

Market Recovery by Services for NT

Data used: Average monthly searches by year

Marketing services: All

Region: NT only

NT overall has had a good recovery (36.48%) in search demand.

NT has seen increased search demand in four service areas: SEO (190.25%), Social Media Marketing (64.17%), PPC (23.08%) & Web Design (6.33%)

NT has seen a decrease in search demand for one service area: Marketing (-22.39%)

Branding search terms have no demand in NT.

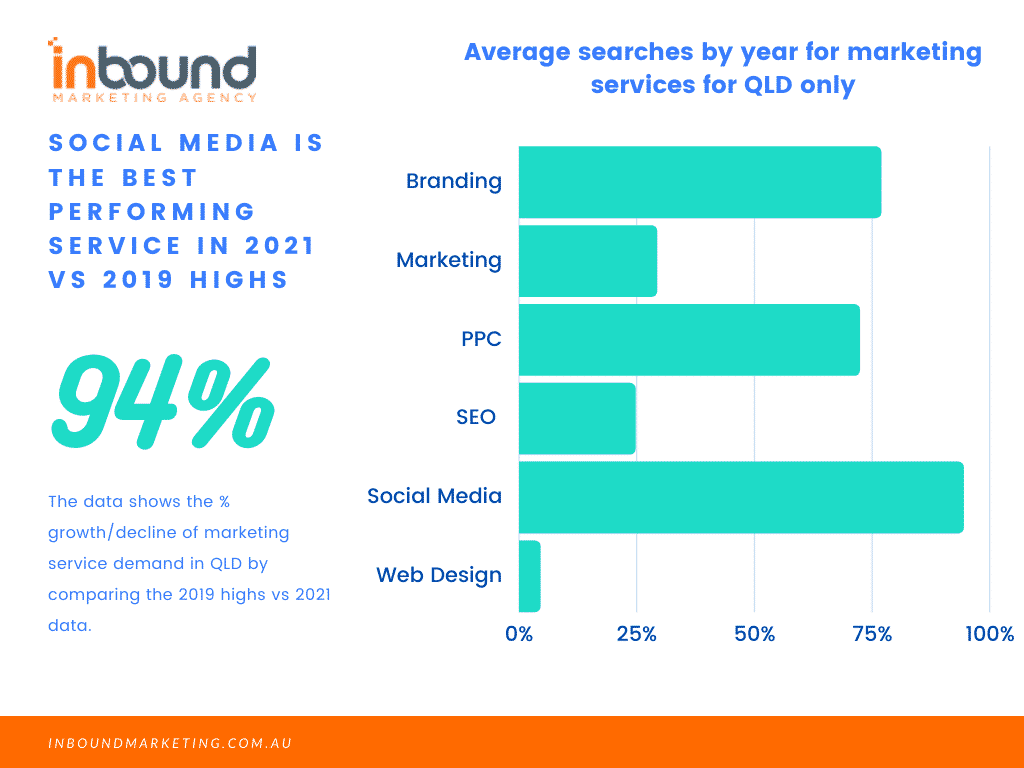

Market Recovery by Services for QLD

Data used: Average monthly searches by year

Marketing services: All

Region: QLD only

QLD overall has had a good recovery (28.51%) in search demand.

QLD has seen increased search demand in all service areas: Social Media Marketing (94.40%), Branding (76.87%), PPC (72.34%), Marketing (29.25%), SEO (24.67%) & Web Design (4.47%)

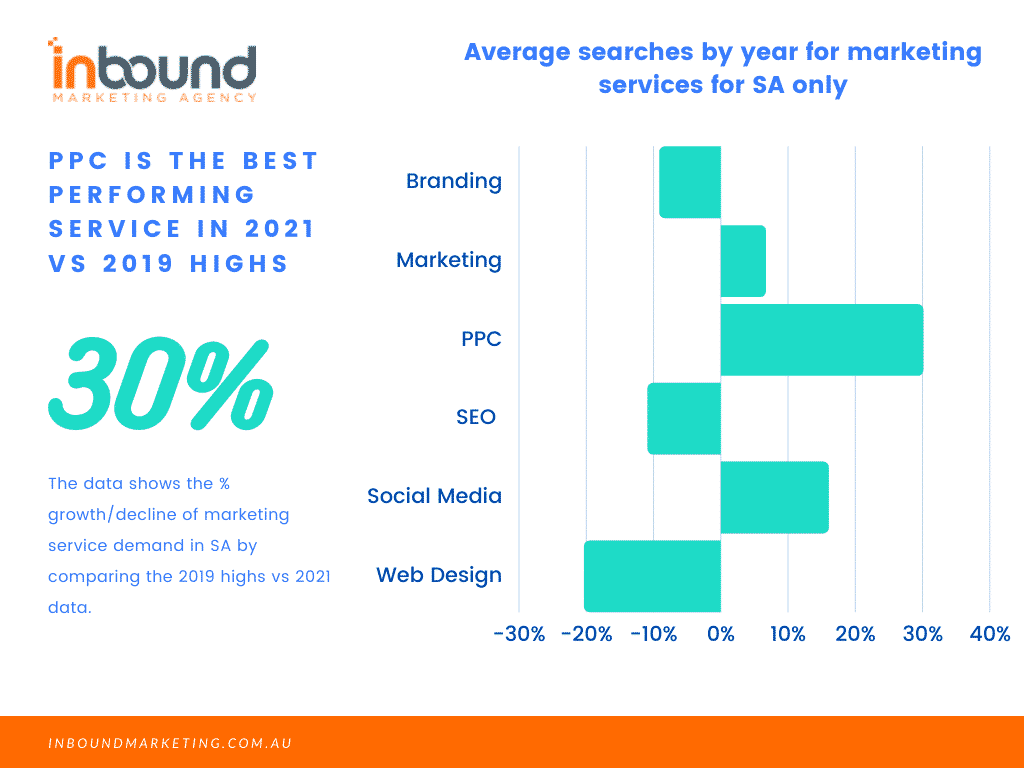

Market Recovery by Services for SA

Data used: Average monthly searches by year

Marketing services: All

Region: SA only

SA overall has had a poor recovery (-8.46%) in search demand.

SA has seen increased search demand in three service areas: PPC (30.06%), Social Media Marketing (16.00%) & Marketing (6.65%)

SA has seen a decrease in search demand for three service areas: Web Design (-20.28%), SEO (-10.84%) & Branding (-9.08%)

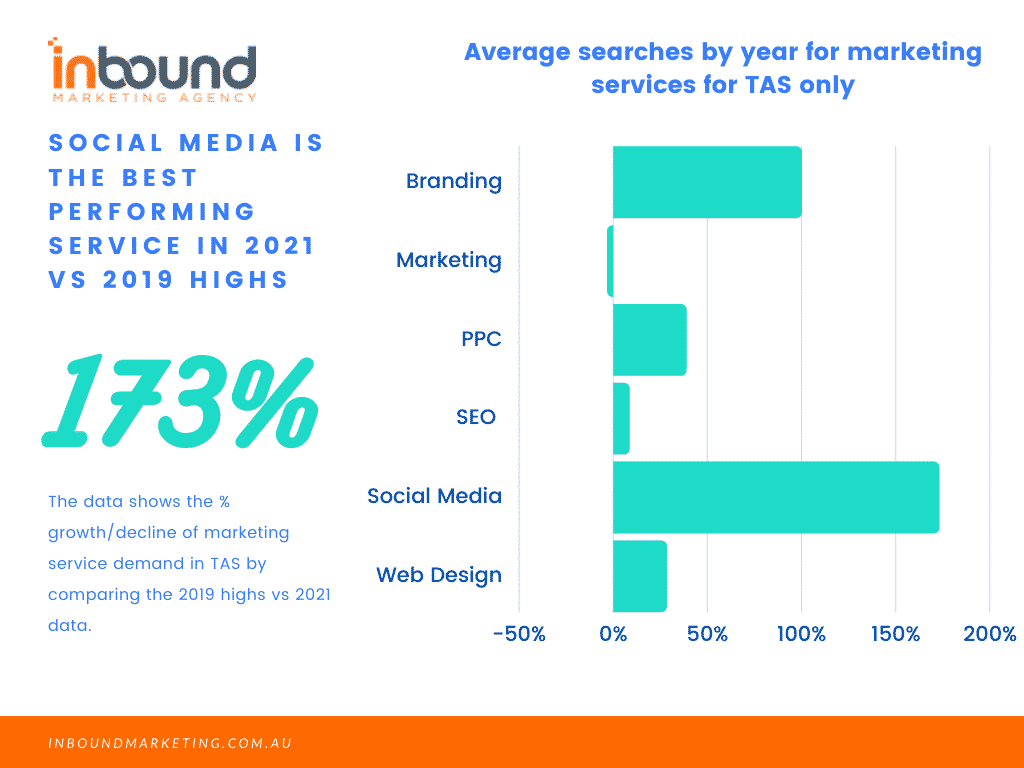

Market Recovery by Services for TAS

Data used: Average monthly searches by year

Marketing services: All

Region: TAS only

TAS overall has had a good recovery (21.03%) in search demand.

TAS has seen increased search demand in five service areas: Social Media Marketing (173.01%), Branding (100.00%), PPC (38.78%), Web Design (28.27%) & SEO (8.53%)

TAS has seen a decrease in search demand for one service area: Marketing (-3.03%)

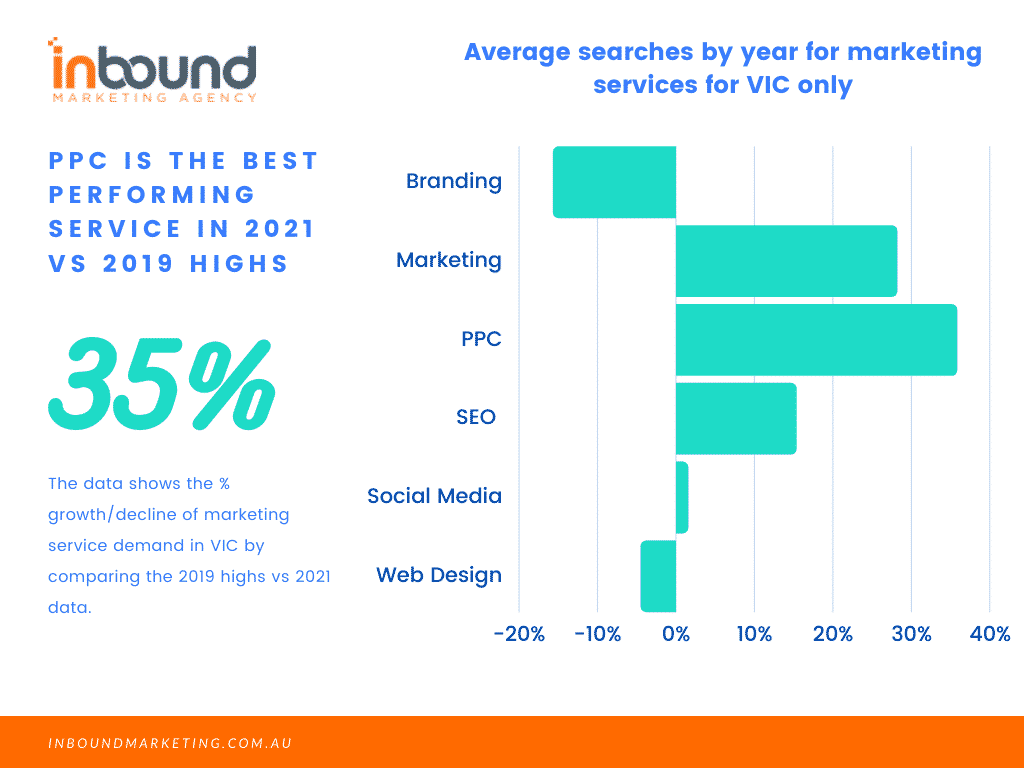

Market Recovery by Services for VIC

Data used: Average monthly searches by year

Marketing services: All

Region: VIC only

VIC overall has had a good recovery (11.15%) in search demand.

VIC has seen increased search demand in four service areas: PPC (35.80%), Marketing (28.16%), SEO (15.32%) & Social Media Marketing (1.52%)

VIC has seen a decrease in search demand for two service areas: Branding (-15.63%) & Web Design (-4.45%)

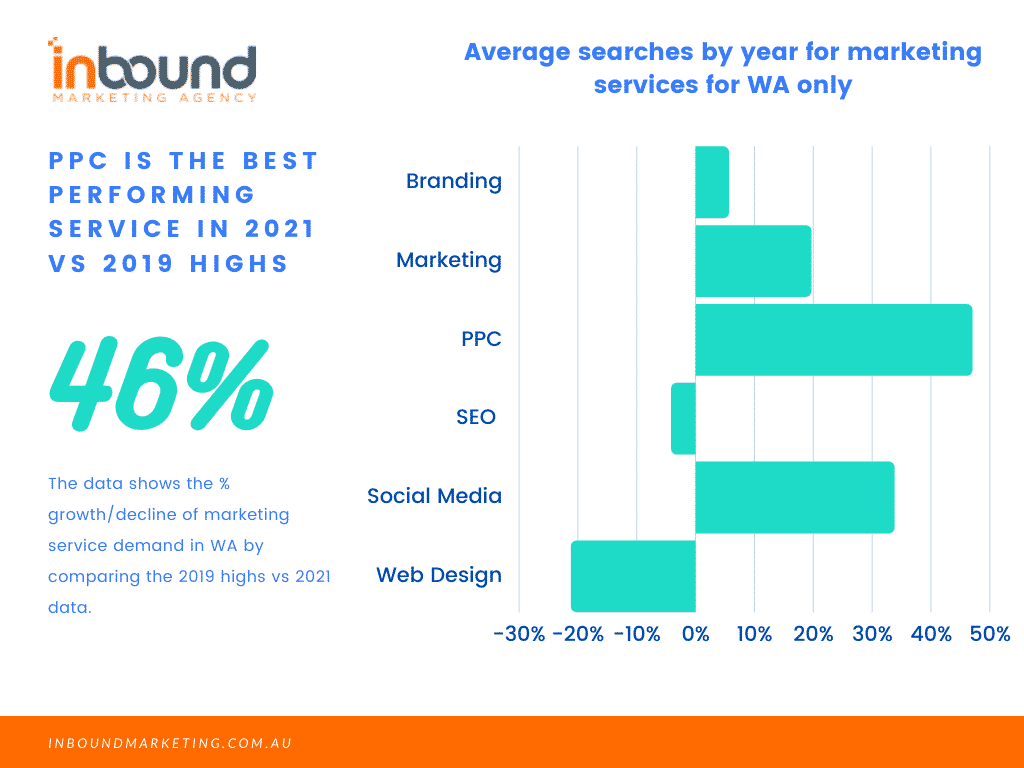

Market Recovery by Services for WA

Data used: Average monthly searches by year

Marketing services: All

Region: WA only

WA overall has had an average recovery (-0.44%) in search demand.

WA has seen increased search demand in four service areas: PPC (46.98%), Social Media Marketing (33.74%), Marketing (19.60%) & Branding (5.60%)

WA has seen a decrease in search demand for two service areas: Web Design (-21.11%) & SEO (-4.09%)

Insights

From an agency perspective, based in WA, the results seem to tie up with reality. There has been a big uptake in advertising and social media as clients look for quicker results.

For agencies, the data might give you a better idea of what service offerings to suggest to new clients in your region. We feel the shift away from SEO, in particular, is a big opportunity in the long term. Clients that have invested in their SEO have generally sustained profitability. With less interest, it opens the path for those willing to invest in organic search.

The raw data and research sources can be found below. We have to stress that this was a basic exercise in trying to identify a general trend. Hence further analysis is required for more detailed findings. Either way we hope it has been useful.

Data & Sources

- Raw Google Adwords Data: docs.google.com

- Australian Bureau of Statistics COVID-19 Statistics: abs.gov.au

- KPMG COVID-19 Business & Economic Implications: home.kpmg

- Wikipedia COVID-19 Pandemic in Australia: wikipedia.org

- Parliament of Australia COVID-19 Government Announcements: aph.gov.au